Imagine you’re in a situation where you urgently need money—maybe it’s a medical emergency, an unexpected home repair, or an opportunity that requires immediate cash.

You decide to apply for a personal loan, but there’s a hurdle: your CIBIL score is either low or non-existent. The frustration sets in, and you find yourself asking, “Is it even possible to get a loan without a CIBIL score?”

You’re not alone in this dilemma. Many people in India face the same challenge due to their CIBIL score. But what if I told you there are ways to secure a personal loan even without a CIBIL score?

It’s true! While traditional lenders heavily rely on this score, alternative options exist to help you get the funds you need.

This blog will guide you through the process of obtaining a personal loan without a CIBIL score. We’ll explore why this score is important, the challenges it can present, and most importantly, how you can overcome them.

What is a Personal Loan?

A personal loan is an unsecured loan that allows you to borrow money without needing to offer any collateral. It can be used for various purposes, such as covering medical expenses, funding education, traveling, or consolidating debt. Since personal loans are unsecured, lenders typically rely on your credit history to determine whether to approve your application and what interest rate to offer.

What is a CIBIL Score?

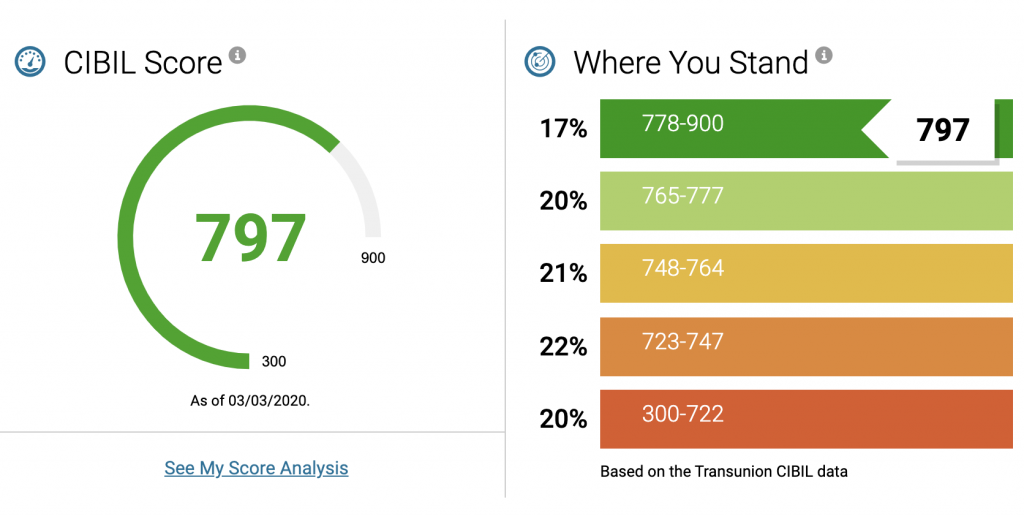

The CIBIL score, provided by the Credit Information Bureau (India) Limited, is a three-digit number representing your creditworthiness. It ranges from 300 to 900, with 900 being the highest score possible. The higher your score, the more likely you are to be approved for a loan with favorable terms.

Lenders consider a score above 750 as good, increasing your chances of getting a personal loan with a lower interest rate. However, if your CIBIL score is low or you have no credit history, securing a loan can be challenging.

Why Does a CIBIL Score Matter?

The Role of CIBIL Score in Loan Approval

Lenders use your CIBIL score as a benchmark to assess your ability to repay the loan. It reflects your credit history, including payment patterns, outstanding debt, and types of credit you’ve used. A high score suggests that you’re a responsible borrower, while a low score indicates higher risk for the lender.

Impact of a Low or No CIBIL Score on Loan Applications

If your CIBIL score is low, lenders may view you as a risky borrower, leading to higher interest rates, lower loan amounts, or even rejection of your application. On the other hand, if you have no CIBIL score—perhaps because you’ve never taken a loan or used a credit card—lenders might hesitate to approve your loan due to a lack of credit history.

This scenario can feel like a catch-22: you need credit to build a credit score, but you can’t get credit without an existing score.

Alternative Lender Options

The good news is that there are ways to get a personal loan without a CIBIL score. Alternative lenders and financial institutions have emerged, offering loans to individuals with little or no credit history. These lenders use different criteria to assess your creditworthiness, such as your income, employment history, and even social media activity.

Here are some alternative options:

- Non-Banking Financial Companies (NBFCs): NBFCs tend to be more flexible than traditional banks, considering factors like your income and employment stability instead of just your CIBIL score.

- Peer-to-Peer (P2P) Lending: P2P platforms connect borrowers directly with lenders, often having more relaxed credit requirements and allowing those with no credit history to borrow.

- Microfinance Institutions: These institutions focus on lending to individuals with low incomes or no credit history, often requiring a group guarantee or collateral instead of a high CIBIL score.

Top 10 Ways to Get a Personal Loan Without a CIBIL Score

If you’re struggling with a low or non-existent CIBIL score, securing a personal loan might seem daunting. However, here are ten ways you can still get a loan without relying on your CIBIL score:

- Apply with a Co-applicant: Boost your approval chances by applying with someone who has a strong credit score.

- Opt for a Secured Loan: Use assets like property, fixed deposits, or gold as collateral to secure a loan.

- Show Proof of Stable Income: Demonstrate a steady income to reassure lenders of your repayment ability.

- Approach NBFCs and Digital Lenders: These institutions are often more flexible with credit requirements.

- Use Peer-to-Peer Lending Platforms: Connect directly with individual lenders who might be willing to offer you a loan.

- Consider Microfinance Institutions: Ideal for low-income groups or those without a credit history, these institutions may not check your CIBIL score.

- Apply for a Smaller Loan Amount: Requesting a smaller loan can increase your approval chances, even with a low credit score.

- Leverage Your Employer’s Bank Relationship: If your employer has a tie-up with a bank, you might get a loan with relaxed criteria.

- Use a Guarantor: A guarantor with a good credit score can significantly boost your loan approval chances.

- Look for Pre-approved Loan Offers: Banks might offer pre-approved loans based on your relationship with them, even if your CIBIL score is low.

By exploring these options, you can secure a personal loan without a strong CIBIL score, helping you meet your financial needs promptly.

How to Apply for a Personal Loan in 4 Easy Steps

Ready to apply for a personal loan without a CIBIL score? Follow these four simple steps:

- Research Your Options: Start by researching lenders that offer personal loans without a CIBIL score requirement. Compare interest rates, processing fees, and other terms.

- Check Eligibility: Ensure you meet the lender’s eligibility criteria, which might include minimum income requirements, employment stability, or the ability to provide collateral.

- Prepare the Necessary Documents: Gather all required documents, typically including proof of identity, address, income, and employment.

- Submit Your Application: Once you’ve chosen a lender and prepared your documents, submit your application either online or in person. Be honest and accurate in your application to avoid delays or rejections.

FAQs

- Can I get a loan without CIBIL?

Yes, you can get a loan without a CIBIL score by approaching alternative lenders like NBFCs, microfinance institutions, or peer-to-peer lending platforms. These lenders may consider your income, employment stability, and other factors instead of your credit score. - Can I get a personal loan if my CIBIL score is 500?

Getting a personal loan with a CIBIL score of 500 is challenging but not impossible. You may need to approach NBFCs, consider applying with a co-applicant, or provide collateral to improve your chances of approval. - How to get 20,000 rupees urgently?

To get 20,000 rupees urgently, consider applying for an instant personal loan through digital lenders, borrowing from a peer-to-peer lending platform, or using a credit card cash advance if available. - How to get 2 lakhs immediately?

To secure 2 lakhs immediately, approach NBFCs, apply for a personal loan online with digital lenders, or consider using assets as collateral. Having a stable income and good financial documentation will improve your chances. - Is Buddy Loan safe?

Yes, Buddy Loan is considered safe as it is a trusted platform that connects borrowers with lenders. However, always read the terms and conditions carefully and ensure that the lender is reputable. - What is loan type 70 in CIBIL?

Loan type 70 in CIBIL refers to a credit card-related loan. This category is used to track loans or credit lines linked to credit card accounts.